ev charger tax credit 2021 california

Up to 1000 state tax credit Local and Utility Incentives. Technically referred to as the Alternative Fuel.

After expiring at the end of 2021 the Internal Revenue Code Section 30C tax credit for electric vehicle charging stations is back.

. See if you can receive a rebate for installing an EV charger in your home or business. Southern California Edison SCE offers a special rate to customers for electricity used to charge PEVs called TOU-D-PRIME. Over 9000 in California EV rebates and EV tax credits available.

The program is limited to vehicle owners residing in. More incentives rewards rebates and EV tax credits are available to people who purchase or lease qualifying Battery Electric BEV or Plug-in Hybrid PHEV. Electric Vehicles Solar and Energy Storage.

View a list of federal state electric car tax credits incentives rebates broken out by state. Call Energy Management at 800 552-7658 for more. Learn more about EV tax rebates in CA.

For example if you purchase an EV eligible for 7500 but you owe only 4000 in taxes you will receive a 4000. Compare electric cars maximize EV incentives find the best EV rate. Similar tax breaks have expired and been extended in recent years and in its current form it applies to property placed in service through the end of 2021.

Federal EV Charging Tax Credit. Discover electric vehicle tax credits in California and buy a new Toyota PHEV at our Victorville Toyota dealer. Customers who purchase EV chargers.

Replace your older high-polluting vehicle with a hybrid or electric vehicle and you could be eligible to receive up to 9500. This Time-Of-Use TOU rate plan has the same periods as our TOU. Ad Homeowners and businesses who install an EV charger may qualify for rebates and incentives.

Theres an EV for Everyone. Reduced Vehicle License Tax and carpool lane access. A rebate of up to 500 is available through ChargeWise for the installation of a Level 1 or Level 2 EVSE charging station.

Receive a federal tax credit of 30 of the cost of purchasing and installing an EV charging station up to 1000 for residential installations and up to 30000 for commercial. Learn about EV rebates for California other states. The federal government offered an EV charger tax credit known as the Alternative Fuel Infrastructure Tax Credit for equipment and installation.

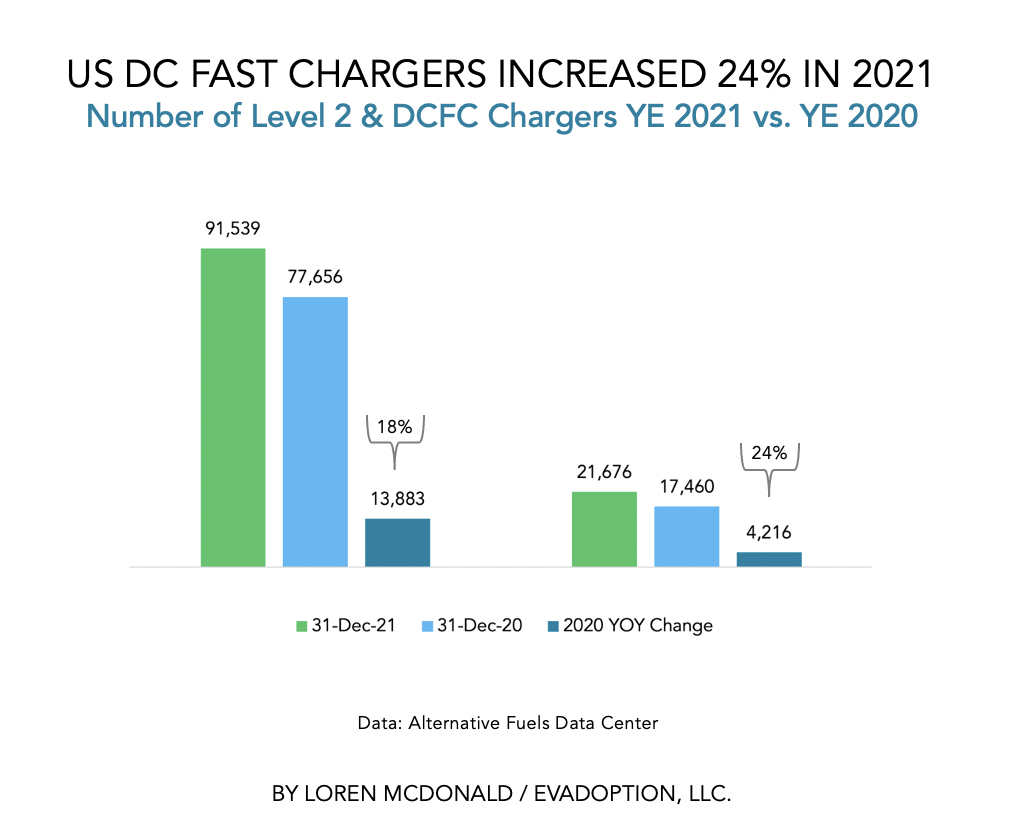

Note that the federal EV tax credit amount is affected by your tax liability. The goal of the CalCAP Electric Vehicle Charging Station Program was to expand the number of electric vehicle charging stations installed by small businesses in. As of December 2019 California has 22233 electric vehicle charging outlets including 3355 direct current fast chargers at over 5674 public stations throughout.

U S Senate Democratic Deal Would Expand Ev Tax Credits Reuters

Cec Report Finds California Needs 1 2m Public And Shared Ev Chargers By 2030 73k Installed To Date Green Car Congress

Here S Every Electric Vehicle That Qualifies For The Current And Upcoming Us Federal Tax Credit Electrek

Ev Tax Credit Calculator Forbes Wheels

How The Federal Electric Vehicle Ev Tax Credit Works Evadoption

Rebates And Tax Credits For Electric Vehicle Charging Stations

Why Tenants Are Requesting Ev Charging Stations Enel X Way

U S Senate Panel Wants To Raise Ev Tax Credit As High As 12 500

Ev Tax Credit Calculator Forbes Wheels

How To Claim An Electric Vehicle Tax Credit Enel X

How Do Electric Car Tax Credits Work Kelley Blue Book

Automakers Ask Congress To Lift Electric Vehicle Tax Cap Abc News

U S Ev Charging System A Priority Under Biden S 2 Trillion Infrastructure Plan

Ev Charging Statistics Evadoption

Tax Credit For Electric Vehicle Chargers Enel X Way

The Ev Tax Credit Can Save You Thousands If You Re Rich Enough Grist

Electric Vehicle Tax Credit For 2022 The Complete Guide Leafscore

Electric Vehicles Should You Buy This Year Investor S Business Daily

How The Federal Ev Tax Credit Amount Is Calculated For Each Ev Evadoption